Pi Network Coin’s Dramatic 62% Crash: An Analysis and Future Outlook

Pi Network Coin’s value plunged 62% from $1.97 to $0.737 due to early miners cashing out, lack of a Binance listing, and doubts about its real-world usability. Analysts express cautious optimism about its future potential as market conditions unfold.

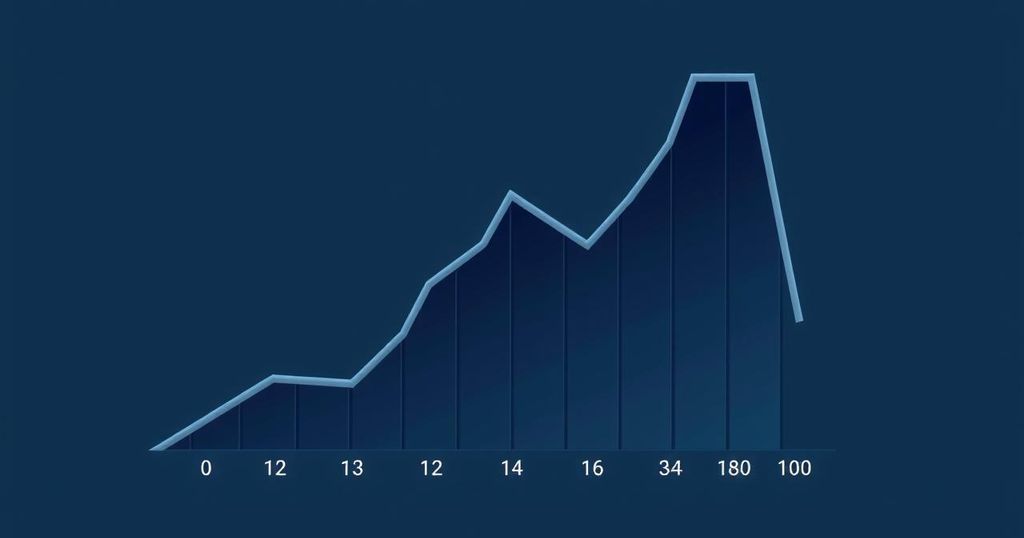

In a shocking turn of events, Pi Network Coin’s value plummeted by 62%, sinking from $1.97 to $0.737 within a single day. This dramatic drop has left investors scrambling for answers. Key factors contributing to this decline include early miners cashing in, the lack of a Binance listing, and serious doubts about the coin’s practical applications in the real world.

A significant element of the crash is attributed to early miners quickly selling their accumulated holdings. After mining through a mobile system since 2019, many users were eager to cash out once trading commenced. This sudden influx of sell orders flooded the market, causing prices to spiral downwards.

Digital currency analyst Kim H Wong shared his observations, stating, “Trading in Pi is disappointing as pioneers keep selling and buy orders are small.” He pointed out that the absence of substantial capital investments further exacerbates the price decline but remains hopeful about future recovery as sellers eventually tire.

Another blow to Pi Coin’s potential is the lack of a listing on the Binance exchange, which is pivotal for boosting liquidity and credibility. Although Pi has been welcomed by smaller exchanges, the absence of Binance’s backing leaves it vulnerable. Recent posts by Binance on X hint at a possible evaluation of Pi but without confirmation, uncertainty looms.

Critics have raised eyebrows at Pi Network’s limited real-world utility. Compared to heavyweights like Bitcoin or Ethereum, Pi lacks a robust ecosystem filled with decentralized applications. Its primary functionalities, including a basic wallet and browser, fall short of attracting serious investment, hampering its application as a widely accepted digital asset.

Adding fuel to the fire, Bybit CEO Ben Zhou labeled Pi Coin a scam and voiced his refusal to list it on their exchange. His statements reflect broader skepticism within the crypto community, reinforcing doubts about Pi’s credibility amidst fierce competition.

Despite these challenges, Pi Network, launched by Stanford graduates in 2019, has made strides in amassing users. With over 110 million installations, it aims to provide a free and easy method for mobile mining. The recent mainnet launch marks a vital transition, allowing users to move their mined coins into external markets, thus broadening its trading horizon.

Mining Pi Coin is simple and energy-efficient. Users can get started by downloading the app, tapping a button daily, and inviting trusted contacts to enhance their mining rate. Trading Pi Coin has become significantly easier now that it is officially listed on exchanges like CoinDCX and OKX, allowing miners to finally monetize their efforts.

Looking ahead, the fate of Pi Network depends on its adaptability and mainstream market acceptance. Experts speculate that with successful real-world utilization and integration into daily transactions, Pi could witness future hikes in value. However, the immediate challenge remains: transforming its vast mining community into active participants in an expanding digital currency economy.

Pi Network Coin’s 62% crash underscores the volatility and uncertainty prevalent in the cryptocurrency landscape. Factors like early miners flooding the market, the absence of a major exchange listing, and limited real-world applications contribute to its downturn. Nevertheless, with a growing user base and potential for future integration into everyday transactions, Pi could still carve out a significant role in the digital economy. The next few years will be crucial to see how this enigmatic coin evolves.

Original Source: m.economictimes.com

Post Comment