Trump’s Victory Sparks Bitcoin Surge: A New Era for Cryptocurrency

Trump’s election has triggered an explosive rise in Bitcoin prices, soaring to $89,000 and boosting the entire cryptocurrency market. Investors expect a more favourable regulatory environment under Trump, who has shifted from sceptic to supporter of digital currencies. His recent venture, World Liberty Financial, introduces a proprietary cryptocurrency, fuelling hopes for industry growth and mainstream acceptance. Industry experts suggest that institutional investments are on the rise as Bitcoin gains traction.

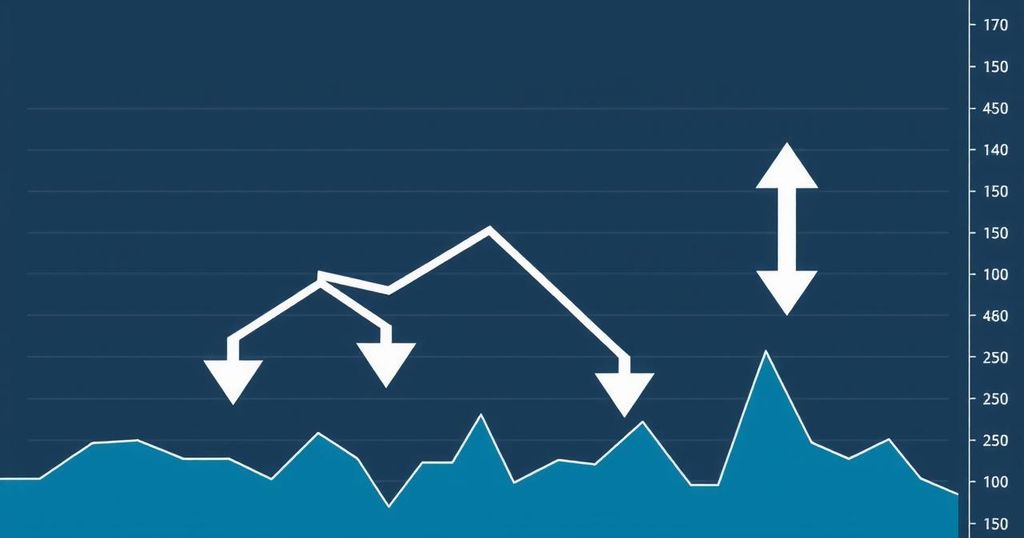

The election of Donald Trump as president of the United States has unexpectedly ignited a fervent rise in Bitcoin and other cryptocurrencies. As investors anticipate a crypto-favouring policy shift in the new administration, Bitcoin prices surged to a staggering $89,000. This marks a significant 30% increase within a week, with other altcoins like Dogecoin soaring an impressive 152%. Analysts speculate that Trump’s previous scepticism has transformed, as he now publicly embraces cryptocurrency, leading to optimistic expectations about the supportive regulatory landscape that could follow his return to power.

During his campaign, Trump not only accepted donations in cryptocurrency but also promised an ambitious vision of establishing the US as the leading global hub for crypto. His recent venture, World Liberty Financial, has introduced a proprietary cryptocurrency, $WLFI, further encouraging belief in a pro-crypto administration. Despite some concerns about potential conflicts of interest and the timing of launching this venture amid the 2024 presidential campaign, supporters see it as a signal of positive changes ahead for digital currencies.

While Bitcoin stands tall at nearly 60% of the market share, the ripple effect of its success is evident across other digital assets, such as Ethereum and Dogecoin. The overall cryptocurrency market has burgeoned to a staggering $2.79 trillion, compared to a mere $1 billion a decade ago. Recent volatility has underscored Bitcoin’s rollercoaster journey, from lows of under $5,000 during the pandemic to record highs today. High-profile endorsements from figures like Elon Musk further fuel the market buoyancy, leaving many to wonder if this is the dawn of a new era for digital currencies under Trump’s leadership.

Trump’s prior stance was one of caution, viewing cryptocurrencies as risks to the stability of the US economy. However, his declaration at the Bitcoin 2024 conference suggests a complete pivot—advocating for the retention of Bitcoin reserves and asserting a desire for crypto innovation to flourish within American borders, igniting speculation about a reinvigorated market.

Additional voices in the tech community, such as Mauvis Ledford, suggest a future where blockchain innovation thrives, potentially transforming governance and appealing to tech investors. Ledford stresses the increasing institutional investment in cryptocurrencies, suggesting a shift toward mainstream acceptance potentially driven by Trump’s policies. Trump’s approach may well reshape the regulatory environment, allowing cryptocurrencies to flourish and solidifying their position in the economic landscape.

The narrative unfolding around Trump’s election reflects a broader trend where political shifts impact financial markets, particularly in emerging sectors like cryptocurrency. Historically, the crypto market has been marked by volatility and regulatory uncertainty, often mirroring political climates. Trump’s initial scepticism about digital currencies contrasted sharply with his recent embrace, signalling a potential shift in regulatory attitudes that could invigorate the cryptocurrency sector. The allure of crypto as an innovative financial instrument continues to grow, with advocates calling for its adoption as a legitimate alternative to traditional currencies.

The cryptocurrency market is witnessing a seismic shift in response to Donald Trump’s election, with Bitcoin leading the charge towards new heights. The anticipation of a more crypto-friendly administration fosters optimism among investors, while the ongoing developments signal a potential reckoning for traditional financial structures. With Trump’s recent engagements boosting confidence in digital currencies, the stage appears set for an exciting era ahead in the financial landscape of America.

Original Source: www.aljazeera.com

Post Comment